Hiring a financial advisor can increase your chances of achieving your financial goals, but that’s only half the battle.

Knowing how to find a financial advisor you can trust is what awaits. But how do you pick? Fortunately, there are certain criteria you can use to identify who to trust based on decades of research and market feedback. So, when selecting an advisor for you, trust the one who trusts the market by using three tried criteria.

1. Avoid stock-pickers

Many people dream of picking the next Amazon, Apple, Netflix, or Tesla and hitting an investing home run. Unfortunately, the reality isn’t always so promising.

In fact, picking winning stocks consistently over long periods is very difficult to do. And that makes sense, especially when you look at the data.

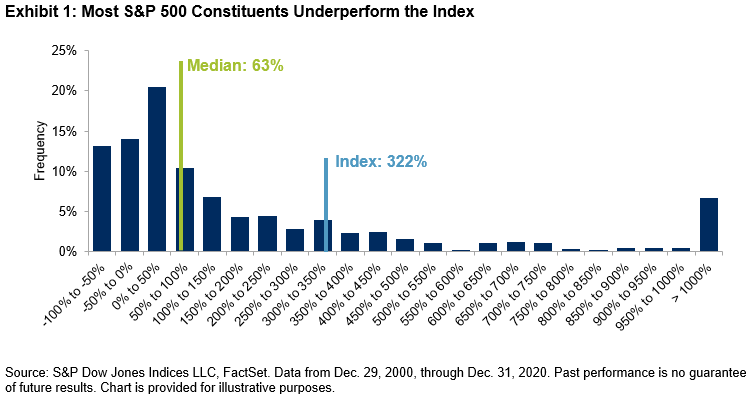

According to research from S&P Dow Jones Indices, LLC, only 22% of the stocks, or 1 in 5, in the S&P 500 outperformed the index itself from 2000 to 2020. To make matters worse, the S&P 500 gained 322% over that period, while the median stock gained just 63%.

So, your odds of picking a winning stock are low. But what about paid professionals? Maybe they can pick the right stocks? Unfortunately, not.

According to the SPIVA U.S. Scorecard, a measure of active versus passive management, 84% of active managers underperform benchmarks after five years. That leaps to a staggering 90% after 10 years and 95% after 20 years.

In addition, while active managers tend to underperform the market altogether, they also tend to charge higher fees for investment management and investment planning. So, do your best to steer clear of stock-picking advisors because they can cost you significantly in fees and underperformance.

2. Avoid market timing

Next, avoid advisors who try to time the market.

Market timing involves actively moving in and out of the market at specific times to boost your overall return. For example, a market-timing advisor might try to sell your investments before a market downturn, then buy back in at the bottom of the downturn.

This sounds great in theory, but it’s nearly impossible to do in practice. That’s because markets move quickly, and no one knows for sure when things will rebound.

In addition, studies show that missing just the 10 best days in the market over the past 30 years would have cut your total returns in half. So, if you get the timing wrong, it can cost you significantly.

On top of that, large returns typically occur during periods of high volatility. In other words, the best days are most likely to happen while you’re sitting on the sidelines in cash, waiting for the market to recover. According to Hartford Funds, 78% of the stock market’s best days happen during a bear market or the first two months of a bull market.

Avoid advisors who use a market-timing strategy, often called an “active or tactical” investment strategy. Instead, find an advisor who understands the importance of investing for the long term and prioritizes time in the market over the timing of the market.

3. Avoid high fees

Lastly, when searching for an advisor, beware of the impact of fees.

Just like investment returns compound over long periods, so does the impact of fees. That’s not to say that an advisor is not worth a fee, they definitely can be, but fees do have an impact. So, when looking for a financial advisor, ask them to explain their fee schedule.

Different advisors charge for their services differently, but here are some things to look out for:

- Be wary of advisors who sell “loaded” mutual funds. A loaded mutual fund is a type of fund that charges an additional fee when bought or sold.

These funds are becoming less common, but ask your advisor if the funds they recommend have any front-end or back-end loads or fees. These can be high, often ranging from 3% to 6% of the investment.

- Understand the all-in fee you will pay, including fund expense ratios. Many advisors charge an asset under management (AUM) fee for their services.

Typically, fees are around 1% of total assets managed if the portfolio is heavily weighted toward large U.S. stocks, though many advisors have a flat minimum fee to consider. But keep in mind that the AUM fee you pay is in addition to the investment fund expenses you will pay.

Depending on the specific funds your advisor recommends, those fees can be as low as zero or as high as 1% to 2%. Discuss these investment fund fees with your advisor and understand why they recommend specific funds if they are more expensive.

- Be cautious of high-fee products like annuities and imprudent life insurance. Annuities and Life Insurance can be great tools when used appropriately in the right situation. However, because of the high commissions, they can produce for an advisor, they can often be misused or overused.

Typically, these financial products have high fees and generate high commissions, so the temptation for an advisor to offer them can be strong. In addition, many have complicated terms that make the products confusing. They can include high fees for taking out excess money from the contracts or canceling them.

While these products may be suitable for some, they should be cautiously applied to a financial plan, and any client should have a strong understanding of what the product will and will not do under various circumstances.

Ultimately, it’s critical to understand that the market is a powerful wealth-building machine. And over long periods, it rewards those that can stay invested broadly while keeping fees low. According to David Booth, Executive Chairman and Founder of Dimensional Funds, it can be beneficial to think of the market as an “information processing machine.”

He writes, “Prices change as millions of buyers and sellers react to new information coming into the market. Prices settle at “fair” values that seem reasonable to both the buyer and the seller. This should be reassuring to people and give them the confidence to trust the market rather than to fight it.”

Armed with this knowledge, you can feel confident when selecting an advisor who knows and trusts the power of the market.

Tencap Wealth Coaching is here to help

If you’re interested in working with a financial planning professional who understands and trusts the market to ensure your financial success, then Tencap Wealth Coaching is here to help.

Tencap Wealth Coaching is focused on helping you achieve your financial goals and more through academically sound financial planning. From investment planning to retirement planning services and implementing a good tax strategy, we manage the complexities of your money and allow you to relax and enjoy life with your family.

Nick Carrigan

Nick trains and develops families in creating, maintaining, and growing wealth. This includes educating clients on the science and academics of investing, comprehensive financial planning, and ongoing coaching to ensure discipline for a lifetime. Nick has seen this create incredible levels of freedom, fulfillment, and love for the families he works with.

-

Nick Carrigan#molongui-disabled-link

-

Nick Carrigan#molongui-disabled-link

-

Nick Carrigan#molongui-disabled-link

-

Nick Carrigan#molongui-disabled-link