Are you a public employee in Utah and ready to reap the rewards of your hard work and retirement planning? Discover how to make the most of Utah’s Retirement Systems (URS) with this comprehensive guide!

Here, you will find an overview of all available options, along with stories of public employees and how they use the Utah Retirement Systems to prepare for a healthy and secure retirement.

What is Utah Retirement Systems (URS)?

Utah Retirement Systems, or URS, is a component unit of the state of Utah that provides retirement and insurance benefits exclusively for its public employees.

With over 240,000 members and approximately 478 public employers—including local governments, school districts, and higher education institutions—the organization significantly impacts the retirement and insurance options of Utah public employees.

Fortunately, Utah’s pension system is in a healthy position, with a 96.6% funding ratio, the fourth highest public pension in the country.

Exploring Your Options at a High Level: Tier 1 And Tier 2

What is the Tier 1 Pension Plan?

The Tier 1 Pension Plan is a defined benefit pension plan that provides retirement benefits to government employees hired before July 1, 2011. It comprises six different retirement systems with unique rules and benefits for each.

Hired after July 1, 2011? Review the Tier 2 Pension Plan.

What are the benefits of the Tier 1 Pension Plan?

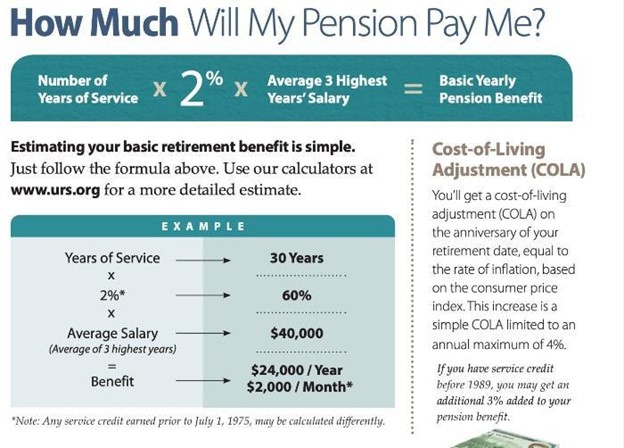

Tier 1 Plan provides retirees with a guaranteed monthly payment based on a formula that considers the employee’s years of service, average salary, and retirement age. In addition, benefits are paid for life and may include survivor benefits for spouses and dependents and cost-of-living adjustments to keep pace with inflation.

Who are eligible for the Tier 1 Pension Plan?

To be eligible for Tier 1 Pension Plan benefits, you must’ve been hired before July 1, 2011, and enrolled in one of six retirement systems, such as Non-Contributory or Public Safety.

How to calculate the benefits under the Tier 1 Pension Plan?

Monthly retirement benefits are calculated using a formula that includes your years of service, average final compensation, and retirement age. To calculate your estimated benefit, log into myURS and review the URS calculators.

Photo Credit: URS

Differences from other retirement plans

The Tier 1 Pension Plan is a defined benefit plan, meaning that retirees are guaranteed a certain monthly income. Other plans, such as 401(k), are defined contribution plans that require employees to contribute a portion of their salary to an investment account they self-manage.

Other factors to consider

Employees should also consider potential drawbacks or limitations of the Tier 1 Pension Plan. For instance, the benefits may be reduced if the employee takes early retirement or leaves the public sector. In addition, there are several payout options, so consult a trusted financial advisor when approaching that decision.

What is the Tier 2 Retirement System?

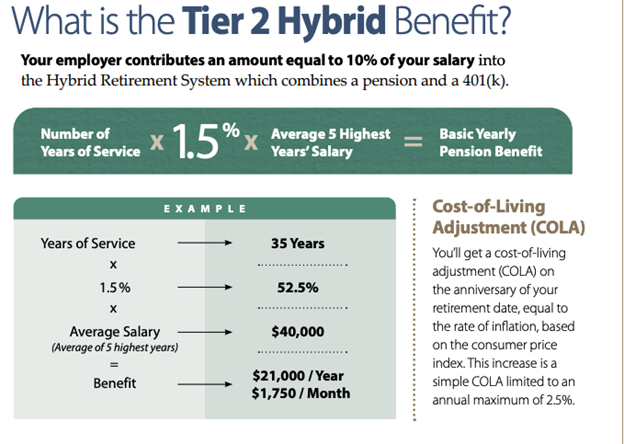

The Tier 2 Retirement System is available to all Utah public employees hired after July 1, 2011. The Tier 2 Retirement System consists of two options, Hybrid and 401(k), which we will cover below.

Photo Credit: URS

What is the Hybrid Option?

Photo Credit: URS

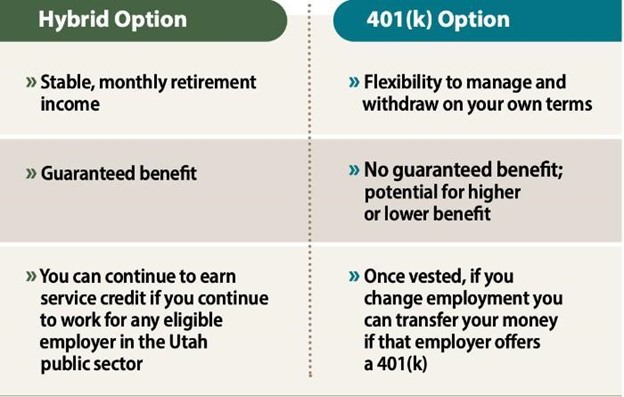

The Hybrid Option offers a combination of a pension plan and a potential employer 401(k) contribution, depending on the pension contribution rate.

This option provides a lifetime income stream based on a set formula. It is combined with a small 401(k) portion that allows employees to contribute funds from their salary, which the employer can match to a certain extent depending on rate settings.

Overall, Hybrid offers a flexible retirement savings plan by allowing for both pensions and defined contribution plans.

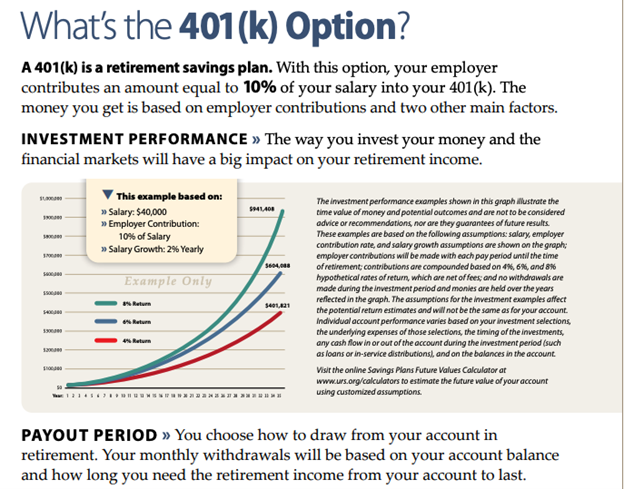

What is the 401(k) Option?

The 401(k) Option is the second Tier 2 Retirement System.

Photo Credit: URS

Unlike Hybrid, the 401(k) Option does not have a pension, making the account its sole focus. Employees receive a 10% employer contribution into their 401(k) and can also contribute a portion of their salary up to the annual contribution limits set by the IRS.

This option gives employees more control over their retirement future because they can choose the investment option and use their 401(k) in retirement. But, it can lack the stability or security that comes with a pension plan, as it will not provide a specific amount of income during retirement. It’s up to the employee to ensure they have enough saved for a secure retirement.

How should you decide between the Hybrid and 401(k) Options?

When deciding between the Hybrid Option and 401(k) Option, here are some things to consider.

First, you have one year from your hire date to choose your retirement option. You can change your selection any time during that year, but your final choice cannot be changed at the end of one year. If you don’t select either option, Hybrid is the default.

Second, when discussing the primary considerations between the two options, URS highlights two unique stories as examples: Jill, who chose Hybrid, and Sarah, who chose 401(k). Let’s explore their stories below.

Meet Jill; she chose the Hybrid Option

Photo Credit: URS

Why did I choose the Hybrid Option?

“I like the idea of getting guaranteed monthly income and the peace of mind a pension provides. I plan on working as a Utah public employee for most of my career and continuing to build my URS retirement benefit. I looked at the benefit formula, and if I work until the age most people normally retire, I can expect a pretty substantial monthly retirement benefit.”

Meet Sarah; she chose the 401(k) Option

Photo Credit: URS

Why did I choose the 401(k) Option?

“I’m excited about the potential of the markets, and I like the idea of playing a more active role in my retirement. I like taking the chance that my investments might outperform what a professionally managed pension could give me, and I accept the risk that it might end up less. I expect to work at several different places in my lifetime. Once I’m vested after four years, my 401(k) is mine—I like the flexibility.”

Ultimately, both have benefits and drawbacks, but the key is to select the best option based on your unique career, financial goals, and personal situation.

Lastly, Tencap Wealth Coaching is here to help

Ultimately, if you want to work with an unbiased financial planning professional to better understand your retirement options, Tencap Wealth Coaching is here to help.

At Tencap Wealth Coaching, we’re focused on helping you achieve all your financial goals and more through academically sound financial planning. From investment management to retirement planning and tax strategies, we are here to manage the complexities of your money and allow you to relax and enjoy life with your partner.

Learn more or schedule an introductory meeting below.

Schedule a meeting.

Nick Carrigan

Nick trains and develops families in creating, maintaining, and growing wealth. This includes educating clients on the science and academics of investing, comprehensive financial planning, and ongoing coaching to ensure discipline for a lifetime. Nick has seen this create incredible levels of freedom, fulfillment, and love for the families he works with.